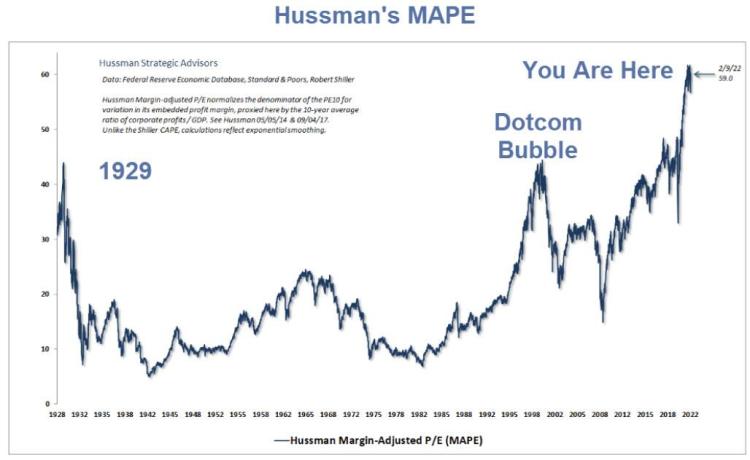

John Hussman warns that people may not realize how much stocks are likely to crash

Dr David Evans supplied some interesting links and adds “The biggest theme in markets is that ratios eventually revert to their mean (or average). No, it’s not different this time. A return to average on this graph implies a drop of about 75%.”

Hassman Margin-Adjusted P/E (US stock market price-earning ratio (adjusted))

John Hussman: Investors are paying top dollar for top dollar

Why is it so hard to accept that speculative bubbles can burst? Interest rates were driven to zero for a decade. Yield-starved investors chased stocks to valuations beyond the 1929 and 2000 extremes. That speculation front-loaded more than a decade of future market gains into the present. Those gains are now behind us, embedded in breathtaking multiples. If history is any guide, a collapse in valuations is likely to return those gains to the future.

The process of losing speculative gains and recovering them over time is what I’ve often called a “long, interesting trip to nowhere.” It bears repeating that the S&P 500 lagged Treasury bills from 1929-1947, 1966-1985, and 2000-2013. 50 years out of an 84-year period.

Now, it’s not impossible to “grow your way out” of extreme valuations, but the arithmetic can be daunting. For example, given that our most reliable valuation measures are about 3.6 times their historical norms, consider this. Even if these valuation measures were simply to touch their historical norms 30 years from today, prices would have to grow about 4% slower than fundamentals for that entire period (1/3.6 ^ 1/30 – 1 = -0.0418). When you realize that S&P 500 revenues, nonfinancial gross value-added, and nominal GDP have all grown at a rate of only about 4% over the past 10, 20, and 30 years, that 4% valuation headwind would combine to leave the S&P 500 unchanged over those 30 years.

Mish Shedlock: Most People Have No Idea How Much Stocks are Likely to Crash

Is there any escape? In aggregate no. For every seller there is a buyer. In this case a buy-the-dipper. Someone must hold every stock every step of the way down, and pension funds will do just that.

Individually, investors have a choice. You can cash out, lighten up, or try to buy value. … But most won’t. It is extremely difficult to believe what … Hussman is saying, and what I am saying. …

The upcoming decline will shock most bears. Many will buy the dip, then that dip and then the next dip. Some hedge funds will do this with leverage and blow up.

If you just retired and think you have a big next egg and can ride it out in equities, expect your portfolio to fall by 50%, minimum.

If you are age 24 with few assets, you should be rooting for an epic decline. …

For sure, the Fed will “try” to halt the decline. And so will Congress by sloshing money everywhere.

The beneficiary of fiscal and Fed stimulus is highly likely to be gold.

Faith in the Fed is a key driver for gold. And it blew the third major bubble in just over 20 years.

The Fed has no credibility and that should already be obvious. Soon it will be unavoidably obvious.

David Evans also often points out that gold is the currency that competes against the central bankers: “It’s an anti-cheating device”. It’s a rare currency that government can’t print from nothing, and ease into quantitative oblivion.

Though Big Bankers have other tools, such as shorts on a paper-gold market, which discourage punters from running away from fiat dollars into other stores of wealth, like precious metals. And surprise, just as War breaks out, uncertainty goes through the roof and for some reason the price of gold falls $100. None of which make sense but works out well for the Big Bankers. Conveniently.

Dr David Evans: Jo’s other half, mathematician and founder of GoldNerds.

Please bring us (me, actually) up to date on Dr. Evans’ writings on climate models.

40

To me it seems as if Property has become wildly inflated here in the UK. Surely time for a big fall but perhaps people will take their money out of shares and put it in property giving it a further twist upwards

I don’t know about Property prices in Australia and New Zealand. Are they still at a level ordinary people can afford?

90

tonyb, yes, property in Australia remains ridiculously expensive. I believe that’s partly due to the Government following UN amd Agenda 2030 decrees for “compact cities” and thus restricting release of new land for building and encouraging higher and higher density development. The Left have been at war against against the traditional Australian housing model of a single family home on a quarter acre block for a long time.

Australia used to have an extremely high, one of the world’s highest, rates of home ownership, but owning a home is now almost impossible for younger people on a normal income. Now, just as Australia once having some of the world’s cheapest electricity, that is a past distant memory due to government policy.

260

Real estate is way up here in the US as well. Just part of the bubble.

40

In Calgary Alberta Canada I have seen properties that were sold at ~ 1 million last year come back on the market this week at 1.5 million … just stupid increases over the last 18 months but we appear to be at peak insanity now as FOMO / fear of missing out prompts folks to just pay the going rate.

I don’t think this boom has much longer to last before the correction hits.

Same as the stock market I suppose although the stock market appears to be in a somewhat healthy rotation to more value oriented stocks & I don’t think the writers above mentioned that.

10

When the councils and utilities require (and charge for) all the “mod cons” the minimum price heads above $100K very quickly

00

Gold and other precious metals are perhaps the only genuine store of wealth even though they are impractical due to requirements of 1) secure storage and 2) having small enough sizes and a variety of sizes to use for practical transactions.

When currencies were backed by gold, there was some restriction on excessive government spending, now governments can spend without limit.

Thus we see obscenities, to name some of many, such as Australia’s pretend-conservative Federal Government throw one billion dollars to get rid of a native star fish on the Great Barrier Reef without even proper costing or a research plan. Or the NSW Government deciding just to give three billion dollars subsidy to “green” hydrogen which will go straight to the pockets of the Elites.

But back to my main point, the paper value of all currencies in the world far exceeds the value of all gold in existence. So that implies that either gold has far more upside, or most people don’t regard it as a real store of value.

Therefore, even with gold (or other precious metals) it’s difficult to see how wealth can be preserved through a government-induced economic crisis. And even if it could, government would simply ban possession of gold and send its thugs door to door to confiscate it.

So ultimately, the only wealth we have is knowledge we carry in our heads.

150

Yes our levels of house ownership have also dropped sharply. Houses are getting smaller for ordinary people and developers are building top priced executive/luxury houses, but again quite small and way beyond the means of ordinary people. there is also an upsurge in 2 bedroom flats supposedly aimed at those downsizing but there is no storage in them.

30

As per the policy and hopeful prediction of Klaus Schwab and his followers, including traitorous Western “leaders”. All under the auspices of “The Great Reset”.

“You will own nothing and be happy.”

and

“Whatever you want you’ll rent.” (Rent from whom?)

(Of course, as with any policy of the Left, that doesn’t apply to the Elites.)

The Leftist “fact” checkers say they didn’t mean it, LoL.

Original social media post by WEF:

https://fb.watch/bqf-FXEqqo/

130

“So ultimately, the only wealth we have is knowledge we carry in our heads.”

You seem not to have heard the old adage “fine words butter no parsnips” and neither will the “knowledge we carry in our heads” if we are unable to put it to practical use.

33

Sorry to come in late to this party, but…

President Nixon unwittingly (or not) set us up for this by going off the gold standard in the early 70s.

That was , in essence, selling out to the globalists, bankers, Davos and the rest of the oligarchs.

Our one dollar bill used to say on the back of it “Silver certificate” which meant that one could go to any bank and turn in the dollar bill for a dollars worth of silver. Eradicated that as well.

From that moment on we were at the mercy of that motley crew. And now, it is what it is….

10

The world’s economic problems would be solved by returning to a free market model as espoused by Milton Friedman. Well, “returning” is not quite the right word because we never had a true free market but it was once a lot freer than it is now.

Milton Friedman put his views in a popular form in the book “Free to Choose” and in the 1980 TV series of the same name which can be seen for free on YouTube at https://youtube.com/playlist?list=PLXD32Z5YYifX8J3Kp-WBA9Ongy0p1C1u9

60

The first big issues is whether it is even possible to get there from here. How do you undo government and big business corruption of the markets?

Assuming the answer to the first question is yes, the second big issue is how to protect people from becoming collateral damage along the way. Or do we bravely proceed with each individual protecting themselves from the ravages of big government and big business unwinding?

I suspect that government and big business corruption is now “too big to fail” or at least too big to fail without sacrificing the unproductive parts of society.

50

Simple three minute explanation of Milton Friedman’s Theory of Money and Prices.

https://youtu.be/YQPS-9DRPvY

10

Surely the coming bursting of the bubble is just the next phase of the impoverishment of the majority , and must be seen in the same light as AGW and Covid .

The impoverishment of the majority of course being a nice way of saying a huge reduction in the total human “footprint”.

Same plan , same perpetrators.

150

Correct.

20

Since the blog article references the 1929 stock market crash, here is an explanation based upon Milton Friedman about how that was a direct result of government interference in the market.

https://fee.org/articles/the-great-depression-according-to-milton-friedman/

The Great Depression According to Milton Friedman

The Great Depression Could Have Been Avoided if the Fed Had Not So Badly Botched Its Monetary Policy

Ivan Pongracic, Jr

September 1, 2007

SEE LINK FOR REST

60

Anyone who makes a prediction on where and when the markets are going to crash is wrong, unless of course it’s by pure chance. Someone has to win the lotto so to speak. Having said that, yes the chickens will eventually come home to roost. When that time comes it will be our worst financial nightmare.

80

Consider that world economic collapse is part of the WEF plan and that of the Elites for “The Great Reset”.

They did it (accidentally or by design?) in 1929, they’ll do it again.

“You will own nothing and be happy.”

70

Having just come through a period when my duly elected government announced that it would freeze bank accounts of people who legally supported a legal protest, I would like to emphasize one un-sung benefit of holding a portable and non-electronic wealth, such as a gold coin or two, as insurance.

Bank accounts can be frozen en masse, instantly. Had that happened to me, my on-hand reserves of cash would enable me to eat, for as long as they lasted. My next line of reserve would be the gold or silver coins and a trip to the local coin shop. It’s not glamourous, but it would work. There are not very many portable assets that could serve that purpose.

By the way, the GoldNerds workbook is a very cool resource, especially for people who trade on the ASX.

140

Double on tundra

This freezing of bank accounts is truly scary . It’s bad enough it was done to the truckers but to do so against those who donated is dictatorial.

What has been the general reaction of Canadians to this measure? Last poll I saw he was being supported in getting rid of the truckers.

70

And mainstream Australian politicians from the LibLabs and Greens are at least as dictatorial as Trudeau and would likely do the same thing here. And quite probably with the full support of the legacy media and a majority of the Sheeple.

140

Yes it is disturbing that so many of the public have been so enthusiastically subservient

130

I lost sleep, but because I don’t know who else amongst my circle was a donor I won’t generalize.

The non-donors I have spoken with are completely indifferent to the plight of donors. One friend (a former CEO of a professional services firm with 2500 employees) viewed the freezing as no big deal because:

1. As far as he knew it was only a couple of hundred accounts that got frozen, and some of those were multiple accounts held by the same person.

2. Senior bureaucrats in Ottawa can always be trusted to do the right thing

3. After all it was only freezing not seizing, and

4. Yes, they haven’t unfrozen all the accounts yet but he’s pretty sure they’re working on it

In other words, it’s all just been an administrative bother and it will work itself out. I conveyed what it was like to be on the receiving end of the threats, and his exact words were “If I had known at the time, I would have told you not to worry.”

I think that any power will eventually be abused. Others, bless them, still have faith in their institutions.

But now Ukraine fills the news and the whole Emergencies Act is so last week. For some of us, trust is broken while for the rest, the institutional crisis has passed and the bullying is already forgotten.

200

This quote by Marcus Aurelius is one of my favourites and unfortunately recognises that even 2000 years ago people quickly forgot

“Time is like a river made up of the events which happen, and a violent stream; for as soon as a thing has been seen, it is carried away, and another comes in its place, and this will be carried away too.”

Hope things are resolved with you. It certainly makes one think twice about this sort of political donation

130

TonyB I am a fan of his sayings too. My personal favourite:

“The object of life is not to be on the side of the majority, but to escape finding oneself in the ranks of the insane.”

With today’s divisive media, the statement is probably even more valid today than it was then.

130

Didn’t that Doug Ford guy shut down nearly 40 trucking businesses in Ontario?

Guessing some other trucking businesses are happy with that.

And will express gratuity.

Welcome to the path that’s hard to get off of.

30

I would like to see private sellers of gold bullion and other precious metals produce ignots in suitably small sizes that they can be used for everyday small purchases like a loaf of bread.

In other words, a coinage based on precious metals as it used to be, back in the day.

90

Silver coins provide that function quite well, and with prevailing Gold:Silver ratios being at the higher end of their historic range, may even provide some extra upside compared to gold if there is reversion to the mean.

111

We had that with the silver coin idea in Britain on Anglo Saxon times. The trouble is that people kept on chipping bits from the coin until eventually traders refused to accept them.

50

Interesting article on coin clipping in England which carried on until the 18th century

https://coinweek.com/world-coins/clipped-coins/

One of the most diligent clippers bandaged to extract 120 ounces of gold from full sized coins.

20

One major coin clipper in the days of Henry VIII was a keeper of the Royal Mint at Bristol, surname Sherrington. His partner, Seymour, was hanged, but Sherrington not only talked his way out of the Tower, he was praised by Archbishop Latimer in a speech to Parliament and was allowed to keep much of this wealth, reflected today in his home at Lacock Abbey.

Present Sherrington’s have a hard act to follow, but some show oratory potential. Geoff S

60

https://britanniacoincompany.com/blog/coin-clipping-the-great-recoinage-of-1696/

40

Those punishments coming soon for climate denial

20

David obvious pay inequality for women vs men at play again there …. the men got to have a good swing on a rope at the end while the women just got to be warm and were denied their swing!!

Those convicted could expect to be hung if they were male and burnt alive if they were female.

00

You seem to be unfamiliar with what is already available in the bullion market David. Fractional amounts of gold are readily available, less so for silver given its lesser value, but the premiums you pay on fractional coins and bars is astronomical. The smaller the fraction, the higher the premium.

The other problem is that because the value of metals is so high — even though the markets are massively rigged and the prices grossly suppressed — the amount of gold you would need to buy a single loaf of bread would be grains of gold. Not particularly practical, although you could buy 10 loaves and barter some for something else.

For instance Scottsdale Mint in the US does 1/100th ounce minted gold “bars”, but they still retail for $41.67 currently in Oz, discounted to $39.17/100 bars. So that would still be a very dear loaf of bread, or 10 loaves of bread, although I guess a loaf might be worth the price of a car if things get bad enough. Gold is trading at $2,612/ozT AU, so you’re paying nearly 50% premium for your discounted 1/100 ounce fragments, although they are much more liquid than a 1 oz chunk.

You can currently get a 1 ozT cast gold bar in Oz for $2,667, so even for a simple cast bar there is a 2% premium.

The only fractional pure silver I know of is the new Perth Mint ½ ozT coin which is retailing for $29.66 (discounted to $29.36/100 coins). Silver is currently $33.57AU as I write this.

Other than that you have to go for things like the Australian 1966 50cent coins that are 80% silver (0.3416 ozT silver content), but they are sold at collectors prices, and because they fall below the % silver threshold to be classed as bullion, they also attract GST, further increasing their premium (bullion attracts no GST). You can buy 100 50cent coins for $20.73ea. So $2,073 for 34.16 oz silver = $60.68/oz or 80.8% premium. Then you would have to convince some potential seller that your 50c coin is 80% silver, because nowhere on the coin does it say there is any silver in it at all. It could just as easily be a cheap nickel coin to the uninitiated. Stick to pure metals for safety in a SHTF scenario.

It’s a trade-off between the liquidity of a low-denomination coin/bar and the value for money of a large denomination coin/bar that is harder to sell . . . and it all depends on how bad things get.

50

Gold for the mistress

Silver for the maid

Copper for the Smithy

Cunning at his trade

Good, said the Baron, sitting his hall

But iron, cold iron

Is Master of them all

With regards to the 2nd Amendment of the Constitution of the United States of America.

Standing vigil over the 1st.

Great power in keeping priorities straight.

10

David, why not simply use the official coinage?

00

Goldbacks down to 1/1000 ozT

00

Perhaps Dr David Evans could be persuaded to review the “climate change” predictions? We definitely need some reality in that area. Why doesn’t the suggestion that the potential for stock markets collapse and war surprise me?

10

A further consideration is that Governments, especially those with the more fanatical commitments to the UN such as Australia and Canada, want to get rid of cash and make all transactions traceable, trackable and controllable. So cash will become useless and worthless anyway.

70

That is consistent with reducing the “footprint” of those with low social credit scores.

A low enough score will see your digital currency frozen.

It was interesting to see how the un-vaccinated immediately achieved low “social credit” status and were immediately deprived of participation in certain aspects of the economy and society.

The fully compliant couldn’t have cared less , not even perceiving what was being instated.

140

In Vicdanistan, the unvaxxed are still not allowed to work, trade, get haircuts, visit restaurants or public events or visit beauty parlours.

Australia has a social credit system in all but name only.

Given our “leaders” love of everything from the Chicomms and hatred of freedom, it’s only a matter of time before Australia formally adopts a social credit system.

https://www.forbes.com/sites/traceyfollows/2021/10/07/are-social-credit-systems-coming-to-the-west/

Oct 7, 2021

Are Social Credit Systems Coming To The West?

100

Ah, the moral cloaking. It’s reminiscent of the pamphleteering of eighteenth century projectors sitting in garrets off Grub Street and labouring with their quill pens “for the Universal Benefit of Mankind”.

30

” “1984: THE BILL” – THE TRUSTED DIGITAL IDENTITY”

https://www.malcolmrobertsqld.com.au/1984-the-bill-the-trusted-digital-identity/

70

Actually, there are choices in this day and age (in the USA, anyways). There are Mutual Funds that trade like stocks, (they’re called EFTs), and there are ones that mimic various indexes, Dow Jones, SP 500, NASDAQ, ect. And most importantly, there are ones that sell short. You can now easily be a punter betting on stocks. and stock indexes, going down.

Food for thought. . .

00

“Food for thought. . .”

Your immediate thought should always be that the game is rigged , the house always wins , and you will ultimately lose , no matter how clever you are.

90

Braun,

Consistent with the barrage of tv commercials mouthing “Gamble Responsibly”.

It is impossible to gamble responsibly.

But, happily, the advertising industry can change that.

Advertising is overall out of control. Its main controllers know little about how nations work, what is socially good or bad, yet they take money from anyone who offers money.

Curses like global warming and epidemic lockdowns and net zero C are enabled by advertising. Take it away and there is nothing (except contented people). Geoff S

50

You pays your money and you makes your choice. . .

The larger the timescale the easier it is to time the markets. The shorter, the harder. In the US, you get in when the Fed is easing and get out when the Fed is tightening. Now, though, there are available tools to make the counter (and much less frequent), downside opposite trade.

10

Hussman has been bearish on the stock market since around 1956

20

Yes, that is the problem with market commentators. For every bear you will find a bull and vice versa. And their track records often rival trained monkeys throwing darts.

40

I totally agree with the above, except I don’t. I’m not saying I know a lot about economics, but I know enough to see that the old rules of economics don’t seem to apply any more. Why that is the case I don’t know, only that just about every prediction made by economists and other ‘experts’ over the past few years have been hopelessly wrong. It’s like somebody changing the laws of physics.

Take gold for example. I agree everybody should have some, though not necessarily as an investment vehicle. There was much talk among those experts mentioned, before the Ukraine invasion, that gold would rocket. Well it DID shoot up (a bit) but nowhere near their expectations. Not only that, it came down again even before the Russian army got to Kyiv. It will be interesting to see what happens on Monday, with the fighting becoming more desperate. But the stratospheric gains predicted simply have not happened, at least so far, so it makes me wonder just what it would take to shake really the confidence of world markets.

Yeah, I know. This can’t go on forever and the bust WILL come. That’s what usually happens, they say. But they’ve been saying that for years. I moved my super out of stocks and into cash more than a year ago, fearful of this and that. Subsequently, I missed out on a sizeable chunk of growth and, the recent falls notwithstanding, I remain behind (though I have some peace of mind). That said, I’m 65 and very aware of the impact a big fall in stocks would have if my super halved today. Retirees can’t just wait it out, especially if you had plans to live it up a little while your health holds out, say the first ten years.

70

Hahaha…

I could see that coming even though it wasn’t mentioned early on.

Precious metals will save you from the government.

Ok, I’ll be honest (as always) and say I fell into the precious metals trap 10 years ago and accumulated 10’s of kilos before my eyes were opened to the lies.

Thanks to Martin Armstrong for showing the reality…

Metals are not some magical post apocalyptic saviour commodity nor is anything else.

Go to Woolies or any other shop and try and pay for your purchase with it and see what happens. Try and barter with it and see what happens. I’ll swap you my lawnmower for 10oz silver. Is that a fair deal? Hands up who knows without using a search engine.

It’s a form of money but then so is a sheep, and a sheep is a way better option.

Governments can cancel their own currencies whenever they want (and have repeatedly throughout history) and can regulate anything they want like metals and crypto so don’t think you’re beating the system by using them.

If you want to prepare for disasters then I’d suggest pay off all your debts (I haven’t even had a credit card for over a decade) then stock up on food, medical supplies and knowledge.

34

I have been debt-free for many years, other than the credit card which is paid in full each month (it’s convenient for payment and I get freebies such as travel insurance). As for my metals, I’ve done pretty well even though I didn’t buy them for growth, averaging 5.5% over the past ten years. Even if I sold them to a dealer today I’d make a very acceptable profit. Plus they’re beautiful!

For me, metals are ‘prepper money’ that can’t be written out of existence by computer code. In such circumstances, you want your metal to be highly divisible – no 1kg bars. If banks ceased to trade and the internet went down, I guarantee folks will trade fuel or meat for metal and definitely not dollar bills if there’s hyper inflation.

Sure, this is an extreme scenario but I don’t see a downside to stashing a bit of gold and silver, especially if they’re storing value as mine has done. Plus they make great birthday presents. Besides, my deposit box wouldn’t accommodate even a week’s worth of lamb chops.

60

Chiefio’s look at the market

https://chiefio.wordpress.com/2022/02/27/market-top-correction-or-drop-tbd/

00

Some metals (eg: Copper, Nickel, Lithium) will be valuable in the short to medium term, as related to the ridiculous idea of ” renewable energy”. (Which, except for wood and possibly water, does NOT exist). Already we are hearing about “Green Mining”. The intellectually challenged governments of the West have no idea how much they have been brainwashed by the “green slime”. Welcome to blackouts!!!

10