By Jo Nova

Finally, a strike at the heart of the Blob

Texas and 10 other US States have pressed the radioactive Antitrust legal button and filed against BlackRock, Vanguard and State Street. The states claim the money managers bought up large stakes in coal companies and then colluded to promote ESG and DEI (diversity, equity and inclusion) goals that reduced coal output. The decreased supply of coal, in turn increased the cost of electricity to consumers. It was fundamentally anti-competitive behaviour. These three companies together have $26 Trillion dollars of assets under management. That’s only one trillion smaller than the entire US GDP.

In this case, some of the collusion hidden in clear view. The three money managers said they were trying to save the world and to protect the people, and they joined groups like the GFANZ and Net Zero alliances like Climate Action 100+. But in the end, these three financial giants had collectively acquired close to 30% of most US Coal companies, and even though they claimed to have good intentions, the 11 State Attorney Generals argue that any extraneous claims of social benefits are irrelevant. These three companies have profited immensely while customers have been denied access to a free and open market, and have paid higher electricity bills.

In a democracy, the people are supposed to decide the policies, not the Oligarchs.

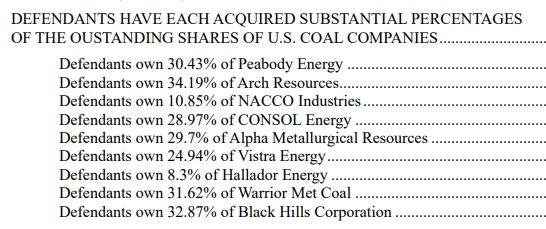

Look at the grip the three supermassive money managers had on the coal industry:

No wonder coal companies were so pathetic at standing up for themselves, and fighting back against the climate propaganda. They were captured by the Blob and held hostage to larger goals:

BlackRock, Vanguard, State Street sued by Republican states over climate push

The defendants were accused of exploiting their market power and involvement in climate advocacy groups to pressure coal companies to slash output and reduce carbon emissions from coal by more than 50% by 2030, driving up consumers’ utility bills.

“Competitive markets — not the dictates of far-flung asset managers — should determine the price Americans pay for electricity,” the states said in the complaint.

Texas Attorney General Ken Paxton, whose office filed the lawsuit, in a statement accused the defendants of promoting an “illegal weaponization of the financial industry in service of a destructive, politicized ‘environmental’ agenda.”

The lawsuit aims to stop these companies from voting on shareholder resolutions or acting in a way to undermine coal output and competition. The Attorney Generals also want money — calling for fines to be paid for the antitrust violation.

From the legal suit:

The free market has been destroyed:

For the past four years, America’s coal producers have been responding not to the price signals of the free market, but to the commands of Larry Fink, BlackRock’s Chairman and CEO, and his fellow asset managers. As demand for the electricity Americans need to heat their homes and power their businesses has gone up, the supply of the coal used to generate that electricity has been artificially depressed—and the price has skyrocketed. Defendants have reaped the rewards of higher returns, higher fees, and higher profits, while American consumers have paid the price in higher utility bills and higher costs.

The three financial giants have violated the Clayton Act (Antitrust legislation)

Defendants are three of the largest institutional investors in the world. Each Defendant has individually acquired substantial stockholdings in every significant publicly held coal producer in the United States. Each has thereby acquired the power to influence the policies of these competing companies and bring about a substantial lessening of competition in the markets for coal. And each has used its power to affect a substantial reduction in competition in coal markets. Considered alone and in isolation, each Defendant’s acquisition and use of producers has violated Section 7 of the Clayton Act.

… Defendants have immense influence over these companies on their own, but collectively Defendants possess a power to coerce management that is all but irresistible.

They have made their goals public

But Defendants have not just acted alone and in isolation. In 2021, they went further. In that year, Defendants each publicly announced their commitment to use their shares to pressure the management of all the portfolio companies in which they held assets to align with netzero goals. Those goals included reducing carbon emissions from coal by over 50%. Rather than individually wield their shareholdings to reduce coal output, therefore, Defendants effectively formed a syndicate and agreed to use their collective holdings of publicly traded coal companies to induce industry-wide output reductions.

And even though they have pulled out of these Net zero alliances, (or Monster Banker Clubs), that doesn’t change the fact that they did engage in anticompetitive behaviour and still continue to threaten the free market.

Pretending to save the world while profiting from collusion is not OK

Defendants have publicly defended their anticompetitive scheme with appeals to environmental stewardship. But acquiring shares of common stock, “the effect of which ‘may be substantially to lessen competition’ is not saved because, on some ultimate reckoning of social or economic debits and credits, it may be deemed beneficial.” … The nation’s antitrust laws “reflect a legislative judgment that ultimately competition will produce not only lower prices, but also better goods and services.” … Defendants’ belief that concern for the climate confers a license to suppress competition is “mistaken.

The antitrust laws don’t permit [the enforcers of America’s antitrust laws] to turn a blind eye to an illegal deal just because the parties commit to some unrelated social benefit.”1 Under the antitrust laws, full and open competition must dictate domestic coal production.

BlackRock has also deceived its own shareholders

Larry Fink the CEO of Blackrock, turned people’s pension funds into his own leftist activist machine. He told them he would maximize their gains, but instead he used their funds to promote his own profits and goals at their expense.

In addition to joining with the other two major institutional asset managers to bring about a reduction in the output of coal, Defendant BlackRock went further—actively deceiving investors about the nature of its funds. Rather than inform investors that it would use their shareholdings to advance climate goals, BlackRock consistently and uniformly represented its non-ESG funds would be dedicated solely to enhancing shareholder value. But as detailed below, BlackRock routinely violated its pledge to investors, using all its holdings to advance its climate goals and—as most relevant here—promote the objectives of its output-reduction syndicate.

The States that may save us all are Texas, Alabama, Arkansas, Indiana, Iowa, Kansas, Missouri, Montana, Nebraska, West Virginia, and Wyoming.

Other countries should be following suit, and looking hard at their own competition laws. We may not have antitrust laws, but most of the West have some kind of competition laws against cartels who misuse their market power.

Related:

The dark bubble: There’s a reason everything seems to be going off the rails simultaneously

- Winning: Antitrust laws slow down the climate plans of $130T monster cartel of UN and global bankers

- 19 US States fight back against BlackRock the Political Climate Police disguised as a Monster Investment Fund

- Well that explains everything: Bankers bullied Australia into Net Zero

Photo of BlackRock Office: Jim.henderson

At last they follow the money . Slowly , then all of a sudden . A huge power play busted….

390

Yes, and the US Anti Trust Laws are there for a number of very good reasons. Obey the Laws or pay the consequences. Big Fines and Jail Terms.

As Jo says – “We may not have antitrust laws, but most of the West have some kind of competition laws against cartels who misuse their market power.”

310

Mmmmm and then you ha e Google

20

Que?

10

There is an edit function here.

00

Same tactics as AGL ?

350

Australian Gas Lighting?

“Gaslighting is a very specific form of emotional abuse and mental manipulation that disrupts your ability to trust others and yourself. While the term has gained popularity online, in reality TV and other pop culture avenues, it’s also a term that’s often over-used to describe other kinds of bad behaviors, like lying, guilt-tripping or shaming.

From the old movie; “Gaslight”

A 1944 American psychological thriller film directed by George Cukor, and starring Charles Boyer, Ingrid Bergman, Joseph Cotten and Angela Lansbury in her film debut. Adapted by John Van Druten, Walter Reisch, and John L. Balderston from Patrick Hamilton’s play Gas Light (1938), it follows a young woman whose husband slowly manipulates her into believing that she is descending into insanity.

Who ‘da thunk it?

70

Franklin Roosevelt gets most of the attention for The New Deal and his leadership during WWII, but my favorite president is and always will be Teddy Roosevelt, who believed in trust-busting, speaking softly while carrying a big stick, preserving natural habitats rather than trying to manipulate the weather 100 years from now, the importance of the ‘man in the arena’ versus the critic, and laughed off getting shot in the chest while on the campaign trail.

Trump has many similar traits/beliefs/policies, and hopefully he picks up Teddy’s mantle as a trust-buster and runs with it in his second term. Big Capital needs to be broken up into smaller pieces to end their stranglehold on the global economy. Ditto for Big Tech, to allow entrepreneurship to flourish without the specter of the FAANG’s swooping in and buying up any startup that shows promise. Might a well bust up Big Pharma while he is at it too.

370

And perhaps in another 10 years we might know the result.

101

Three to five large locomotives haul 100 coal hoppers.

Each coal hopper contains 100 tons of coal.

So, that one mile long Unit of locos and hoppers contains 10,000 tons of coal.

In the U.S. a ‘typical’ Sub Critical Coal fired power plant, (you know, three and four levels of tech lower than the ones in China) the old ones that were constructed in the 60s and 70s, well those Four Unit 2000MW to 2500MW will consume ….. one and a half train Unit loads of coal ….. EVERY DAY.

So, six million tons of coal a year.

Control the price of coal (even by a tiny amount) and there’s a monster windfall, eh! So, by controlling that cost of coal, they are, umm, RAISING the cost of electricity, eh!

I suppose now you get a reasonably good idea why they construct coal fired power plants either at, or very close by coal mines, eh!

Tony.

PostScript – Huh! Imagine the savings if they replaced those ancient dinosaurs with USC and Advanced USC plants, using 15% to 20% less coal for the same power output, hence huge savings on the cost of the coal they consume. Hmm! Who knows? Maybe, electricity would be cheaper.

610

Tony,

When you control something that everything that everyone needs to survive – that’s power . We cannot go elsewhere and get it cheaper or refuse to use it . The engineered panic over “climate change” and nuclear reactors is part of the plan . Interestingly Newcastle has exported 116.7M tonnes of coal this year which would power around 20 power stations (probably more as a lot of the recipients are USC plants) in mostly China and Japan . According to your calculations that’s 1,167,000 coal hoppers….

130

Tony, the mines in the Lithgow area (upto Kandos) exporting coal to Japan, Korea & Taiwan would have loved to have 10,000 t trains. The Zig-Zag rail from Bell was a solution to a political decision to put the rail through Lithgow where politicians owned land. Also, it was a political decision to have the rail go through Katoomba. The maximum size of coal trains was 320ot. A better rail route had been surveyed through Richmond up over the mountain on the side of Bell’s line of road and then over the divide to between Wallerawang and Portland. Because it is straighter and less gradients 10,000 may have been possible. Yes, Wallerawang and Mt Piper power stations are close to the mines. There is a huge amount of coal there going all the way under the mountains to the coast and then under the sea. The traitor Keane expanded the Blue mountains National Park to stop some coal mine development. Mt Piper was planned to have 2 units of 660MW but only one was installed and this does not run at full capacity because AEMO allows unreliable so-called renewables first priority.

200

That’s interesting cementa.

Politics, politicians, self interest.

Have been to Katoomba quite a lot by rail and car, but only been through Bell’s line of road once or twice.

Maybe we should build a fifth coal loader in Novocastria and name it Keane’s Kontribution.

40

A fantastic revelation Jo. It gives us all some hope that this international junket may be reversed. It is fascinating how massive resistance morphs into real action. Resistance to the Green fantasy – or should I say the Green conspiracy – has been gathering momentum for some time. Indeed, there is an “awakening” to the globalist oligarchic forces which have been tightening their grip on the West through diplomatic and economic organisations.

This action of the US states has a hard road ahead. But, by gosh, it is encouragement to the rest of us!

80

Mt Piper has two units, rated at 700 MW each.

https://www.energyaustralia.com.au/about-us/what-we-do/generating-energy/mt-piper-power-station

Wallerawang was closed a few years back.

Crossing the Great Divide was easier than crossing the Blue Mountains which was not achieved until 1813, and the railway followed that path to Mt Victoria. The line from Wallerawang to Mudgee (via Portland) would be using the crossing you describe.

Cheers,

Dave B

30

Maybe in the course of trying to prove their intentions were the best..ie saving the world…they’ll finally be forced to admit there’s no scientific proof for CAGW and no defensible reason for the massive upheaval they’ve caused.

Maybe BoM and equivalent around the world will have to finally submit to audits.

Maybe the EU will have to recompense Australia for their virtual consumer cartel threat that forced/induced LNP to join the net zero madness…maybe..

00

Anyone else reminded of the ubiquitous graffiti “THE KING IS A FINK“

210

Was Rodney suspected of that graffiti.

90

Yes.

Love classic Wizard of Id.

50

Fink…explained as the signature of the mysterious ” Francis Ignatious Nathaniel Krantz,”

00

German for Finch. Alas.

10

And ye shall know them by their name:

Fink ~ a contemptible person, a betrayer, unpleasant, scumbucket, POS, mofo, etc.

(from various dictionaries and I’ll leave it at that so I’m not moderated) 😃

182

On Sky News (Thurs 21 November 2024) Peta Credlin and a contributor both raised the issue of the Government ‘raiding’ moneys held within the Australian Future Fund. At the conclusion of this concerning news item, it was also pointed out that if the government succeeds in this objective, it would not be a stretch to see politicians encouraging Australia’s Superannuation funds to also direct funds held on behalf of their members – into investments favouring the government of the day’s woke agenda.

The latter is already occurring within my superannuation fund , QSuper (part of the Australian Retirement Trust (ART) macro fund). Members of this fund were advised earlier this year that as from 1 July 2024 two main investment options available to them – the Australian Shares Index and the International Shares Hedged Index – would have their Return Objectives modified. This change states, inter alia, that “—- in addition to aim to closely match the returns of the performance benchmark, it also seeks to maintain a lower weighted carbon intensity” (my emphasis).

In summary, if the ART is typical of other Superannuation funds, then one can conclude that such funds are already acting in the interests of their woke Directors & Boards. Or they anticipate that it is in their interest to appear to be endorsing or kowtowing to the government’s clear agenda which is to eliminate companies and businesses invested in the fossil fuel industry worldwide (not just in Australia). On the contrary, I do not believe this is in the best financial interests of QSuper members and those in like funds with similar stated objectives.

360

The Trustees of these Superannuation Funds need to be very careful as a Trustee has a fiduciary duty in Trust Law to act in the best interests of the beneficiaries – The Superannuation Fund Members. And NOT in the interest of the Guv’ment or Unions.

There could be some very interesting Court cases coming up should a Fund underperform having invested in schemes that do not put the interests of the beneficiaries first.

110

It is the reason that Bowen and Co are so opposed to nuclear because nuclear would destroy their union controlled fund’s investments in renewables. Are the banks in breech of their fiduciary responsibilities by denying funding to coal companies? Coal is making good profits but our illustrious banks are denying funding.

Workers should be careful where they send their super contributions. I manage my own and I am no financial genius but my returns are better than most funds with only accounting fees to deduct. The real reason the union super funds are concerned that Dutton will allow members to withdraw some of their super balance to buy a home is that the funds will have less of your money to play with, less profits and less to donate to the ALP. Judging by the reticence of some funds to pay out death benefits they have forgotten that it the memeber’s money, not theirs.

61

Texas, our Texas. . .

50

Miles and miles of Texas…

00

This action is long overdue. I hope it succeeds. In Australia, we also need to address a couple of other related things:

1. Quasi-monopoly companies like AGL have profited by restricting supply. The lower sales volumes that result are more than offset by the resulting higher prices. The people who lose are the general public who get less product (in AGL’s case, electricity) at higher prices.

2. Short-selling creates a group of people who benefit financially by damaging Australian companies. They make most profit if they can destroy a company completely. The people who lose are the general public who are directly or indirectly invested in the Australian sharemarket. Virtually everyone in Australia is invested indirectly in the Australian sharemarket via the superannuation funds. Some of those superannuation funds even lend shares to short-sellers, or they invest via fund managers who lend shares to short-sellers. Those short-sellers only borrow the shares in order to reduce the shares’ value. IOW, to damage people with superannuation.

230

No one involved in the “green” energy scam has good intentions.

Never believe a Leftist or their agents (in any matter whatsoever).

For example they keep telling us that W&S is the cheapest form of electricity production, an obvious lie.

380

The cheapest power comes from old coal fired stations which have long since paid off their capital costs.

Vales Point, which if I remember right is running on a book value of $2 is an example which should be easily understood.

10

Any proposal for any “green” energy project should first require a forensic audit of who are the real financial beneficiaries and how costs to working or poorer people will be increased.

190

A few relevant quotes from Thomas Sowell:

321

AGL has deliberately run down Eraring Power Station to benefit from renewables and electricity pricing. The coal mills are too small for full capacity and have a high maintenance cost. Spending some capital to improve (or replace) the mills could see the station run at 2200MW and give it an extra 25 year life.

300

It’s almost a crime to deliberately run down or destroy such a substantial and essential asset.

Then again, that this sort of destruction is accepted is testament to how lucrative the whole catastrophic anthropogenic global warming scam is.

Back in the day, it would have been unthinkable to allow such a substantial working asset to be run down or destroyed. And shareholders would have demanded that heads roll for doing so.

280

No worries, Wallerawang can supply enough energy to get us through.

Well, it would if they hadn’t blown it up to install a renewables hub.

30

A “renewables hub”, eh? Doesn’t ever seem much action there when we drive past. They call it “Greenspot”. Only noticeable improvement is that whoever owns the surrounding area has made a lot of lawn since the big stack was demolished.

10

Nobody mentioned Eraring on Wednesday as NSW teetered on the edge of a blackout.

30

No need to scare the natives too much. I understand that one of the Units was out. Will be back on soon.

20

Under US anti-trust law this case is basically open and shut- the companies sued are guilty by their very own statements.

120

First we had Robber Barons in the 1800’s who colluded to usurp the wealth and now we have the new Robber Barons in the form of Fink and Co. You should refrain from calling them Oligarchs but instead call them Warlords, as they are hell bent on finishing us off.

120

The ‘Pollies’ are actually better at it. Just ask the Clintons and O’Bummer.

50

Those “Warlords” own the military industrial complex and the “Robber Barons” lust for the natural resources of Ukraine and Russia.

It cannot be more overt but they also own the politicians and media

60

Switching from coal to gas is difficult if not impossible in the US without a direct pipeline supply because of the Jones Act, requiring US vessels (LNG tankers) port-to-port.

https://www.seatrade-maritime.com/regulations/nfe-s-lng-shipments-into-us-won-t-violate-jones-act

So if coal is throttled in such cases the main alternatives are likely to be renewables including biomass, or nuclear.

10

Someone with a connection needs to forward this article to the Trump team immediately!!!!!

Can anybody here do that?

20

I think Ken Paxton and the other AG’s have a direct line to the Trump team.

50

What, just in case they didn’t know? Team Trump will all in with DOJ to drive Finkinstine et al into bankruptcy

10

One of the biggest impediments to this lawsuit will be the ability of the companies to point to public policy of the US government, and claim that following the pressures of those policies works to exempt them from a straight profitability analysis.

This remains a valid defense for them. Not a complete defense – but it will be balanced in against their clear anticompetitive acts.

So this is not a dead-bang winner of a lawsuit. It’s muddy enough to be considered a good basis for forcing a compromise from the companies.

10

The collusion involved will negate that defense and there isn’t an exception for aligning the non-competitive practices with the federal or any other government. What it suggests is that the federal government needs to be sued, too.

10

Trump will change public policy and in a meaningful way. By opting out of Paris and increasing oil and gas production he is putting into action his words that man made climate change is a hoax. Those who adjust their business to cater for a hoax are guilty of perpetuating the hoax.

40

Only 11 states????? There’s something seriously wrong in America.

00

Baby steps

00

Wouldn’t it have been refreshing that instead of our government passing unworkable, illegimate legislation restricting U16 access to social media, that it brought investigations into the green blob in Australia. In particular, those companies and investors running the last of our coal generators into the ground, with decisions based on ideology and profit gouging. This would include AGL, ENGIE, Cannon- Brookes and perhaps Malcolm Turnbull along with his co-horts. Because coal exports are critical for Australia’s export income and electricity prices are the cornerstone of a profitable economy. But no, let’s admonish Elon Musk and Joe Rogan for actually providing forums for information dissemination.

50

[…] JoNova […]

00

[…] Иностранный источник joannenova.com.au/2024/11/11-us-states-sue-blackrock-statestreet-and-vanguard-for-working-as-a-carte… […]

00